how to determine tax bracket per paycheck

Tax Bracket Calculator There are seven federal tax brackets for the 2021 tax year. The irs income tax withholding tables and tax calculator for the current year.

Federal Income Tax Fit Payroll Tax Calculation Youtube

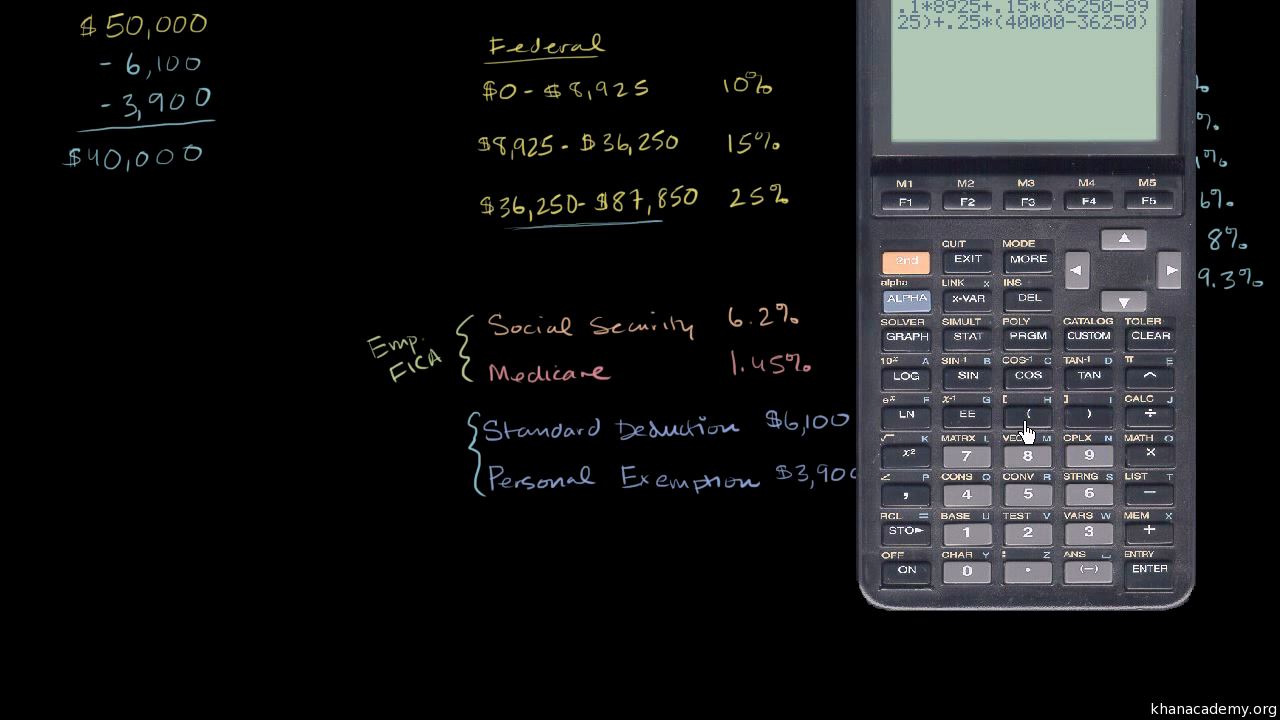

The first 9950 is taxed at 10 995 The next 30575 is taxed.

. See how your withholding affects your. This is tax withholding. 2021-2022 federal income tax brackets rates for taxes due April 15 2022.

How To Determine Tax Bracket Per Paycheck. 10 x 9950. Based on your annual taxable income and filing status your tax bracket determines your federal tax rate.

The state tax year is also 12 months but it differs from state to state. Using the 2021 standard deduction would put your total estimated taxable income at 35250 60350 - 25100 placing you in the 12 tax bracket for your top dollars. 250 minus 200 50.

Using the brackets above you can calculate the tax for a single person with a taxable income of 41049. The easiest way to calculate your tax bracket in retirement is to look at last years tax return. Average tax rate Total taxes paid Total taxable income.

Now use the 2022 income tax withholding tables to find which bracket 2025 falls under for a single worker who is paid biweekly. Use this tool to estimate the federal income tax you want your employer to withhold from your paycheck. Essentially your total tax bill will be 9875.

For 2020 look at line 10 of your Form 1040 to find your taxable income. You find that this amount of 2020 falls in the at least 2000 but less than 2025 range. This parallel tax income system requires high-income taxpayers to calculate their tax bill twice.

Your bracket depends on your taxable income and filing status. First bracket taxation 0-9875 A tax rate of 10 gives us 10 X 9875 9875 Second bracket taxation 9 876-40 125 A tax rate of 12 gives us 40125 minus 9876. On 50000 taxable income the average federal tax rate is 1510 percentthats your total income divided by the total tax you pay.

You find that this amount of 2025 falls in the. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. 10 12 22 24 32 35 and 37.

Take Home Paycheck Calculator Hourly Salary After Taxes

Taxes For Teens A Beginner S Guide Taxslayer

Taxes For Teens A Beginner S Guide Taxslayer

How Much Does An Employer Pay In Payroll Taxes Payroll Tax Rate

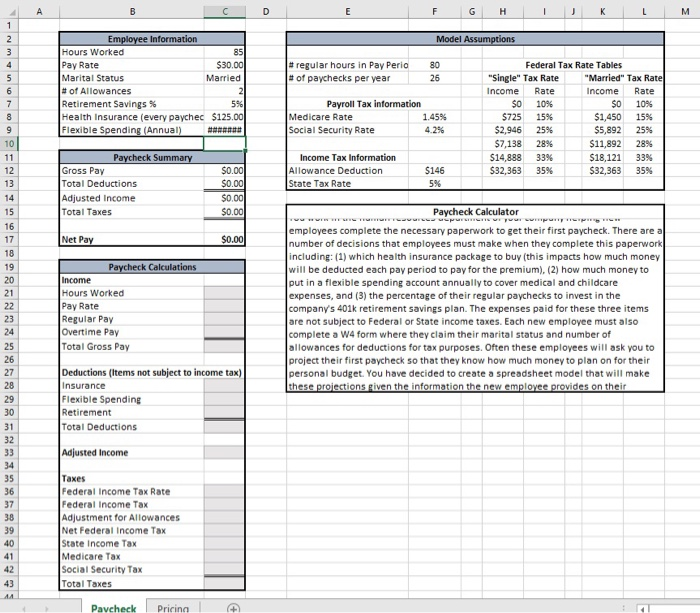

F G H I J K L M Model Assumptions Regular Hours In Chegg Com

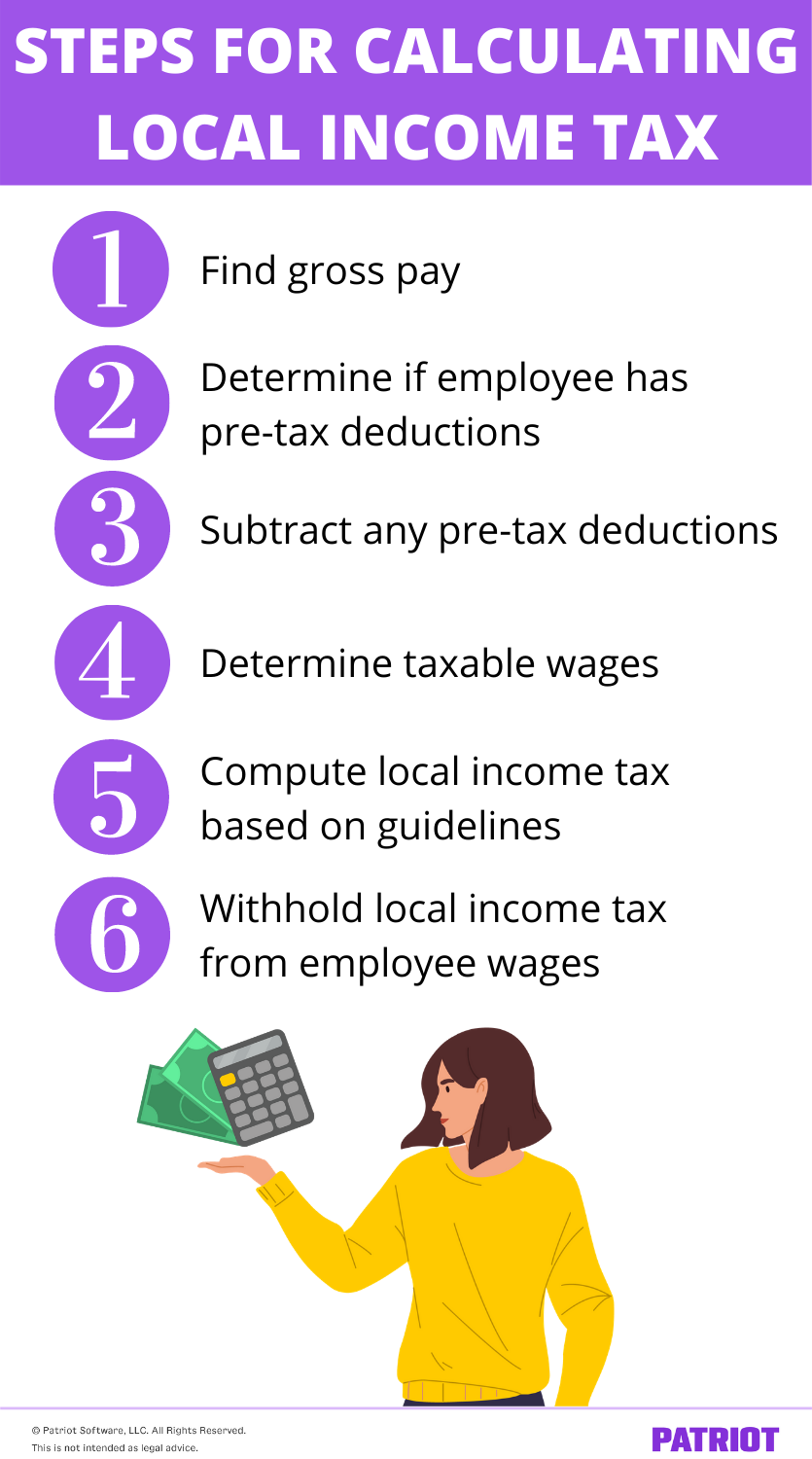

How To Calculate Local Income Tax Steps More

How Do Tax Brackets Work And How Can I Find My Taxable Income

How To Calculate Federal Income Tax

:max_bytes(150000):strip_icc()/with-holding-tax-4186749-V1-6455aa5186fe4122b592a2accb6b8f73.png)

Withholding Tax Explained Types And How It S Calculated

Calculating Federal Taxes And Take Home Pay Video Khan Academy

New Irs Rules Mean Your Paycheck Could Be Bigger Next Year Cnn Business

New Tax Law Take Home Pay Calculator For 75 000 Salary

2022 2023 Tax Brackets Rates For Each Income Level

Esmart Paycheck Calculator Free Payroll Tax Calculator 2022

2021 2022 Tax Brackets And Federal Income Tax Rates Bankrate

Paycheck Tax Withholding Calculator For W 4 Tax Planning

Marginal Tax Rates How To Calculate Ontario Income Tax Kalfa Law